Let's Talk about Value

Earning a college degree is one of the most important investments you will make in your life. According to research by the Federal Reserve Bank of New York, in recent years, the average college graduate with just a bachelor’s degree earned about $78,000 per year, compared to $45,000 for the average worker with only a high school diploma. In other words, a typical college graduate earns a premium of well over $30,000, or nearly 75 percent.*

On average:

- College graduates earn better pay

- Have steadier employment

- Receive better employee benefits

- Live longer and are healthier

- Are more likely to be leaders in their communities

At Indiana Wesleyan, we realize that selecting the right college is not just about finding the best price. We encourage students and families to look at overall fit when making a college choice. However, we do understand the importance of out-of-pocket cost and this is why our financial aid team works individually with each student as they explore investing in an exceptional Christian education from Indiana Wesleyan University. There are numerous resources available to help students with their college investment that will be explored as we navigate this journey together.

It's an Affordable Investment

The “sticker price” (cost prior to subtracting scholarships and grants) at Indiana Wesleyan is competitive when comparing to other like institutions.

![]()

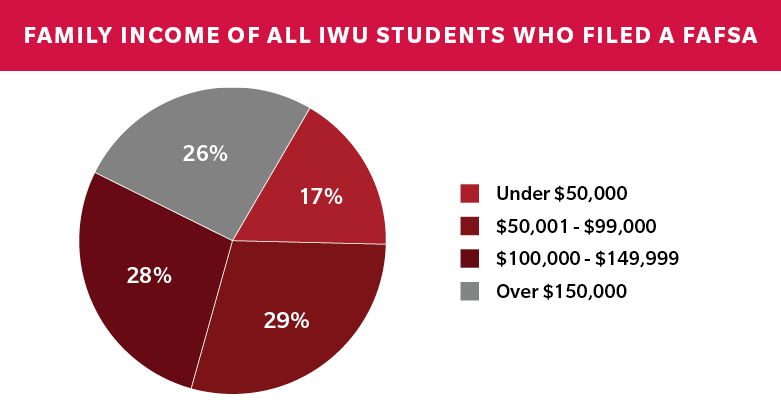

Students come to Indiana Wesleyan from across the United States and beyond to form a dynamic community. Our students represent a variety of family economic backgrounds.

Average Financial Aid Package

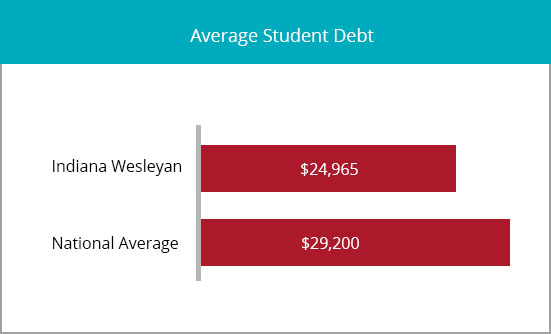

The financial aid team at Indiana Wesleyan prides itself on exploring all potential financial aid resources for students. Sources of potential aid include scholarships, grants, outside aid, and loans.

Indiana Wesleyan average financial aid package = $21,249

The Value of an IWU Education

- 97% Career Outcomes Rate - 6% higher than the national average for private institutions and 17% higher than the national average for public institutions.

- 67% Graduation Rate - nearly 4% higher than the average graduation rate for the major 4-year degree granting public institutions in Indiana (63.25%).

- #1 Best College Dorms in Indiana (Niche.com)

- #5 Best Undergraduate Teaching Programs in Midwest (U.S. News & World Report, 2018)

- #6 Top Schools for Engagement in America (Wall Street Journal/Times Higher Education, 2018)

- #6 Best Bang for the Buck Colleges in Midwest (Washington Monthly)

- #8 Best College Dorms in America (Niche.com)

FAFSA

Important Notice

Indiana Wesleyan has begun receiving some 24-25 FAFSA records from the Department of Education. The Department of Ed. is releasing the FAFSAs to the University in batches, starting with those with the earliest completion date. The Financial Aid office will be diligently working to provide official offer letters as soon as possible to students who have completed the FAFSA, hopefully beginning and continuing throughout April. At this point in time, it is unknown how long it will be until all completed FAFSAs are received. Communications will be sent to students via email if any issues arise.

The 2024–25 FAFSA changes include the following:

- The EFC will transition to the SAI. The SAI is a number that determines each student’s eligibility for certain types of federal student aid.

- The SAI can be a negative number, with a minimum SAI of -1,500

- Every contributor—anyone (student, the student's spouse, a biological or adoptive parent, or the parent's spouse) who's required to provide information on the FAFSA form—will need an FSA ID to access and complete their section of the online form. **For faster FAFSA completion, contributors can create an FSA ID at any time and should plan to do so at least 3 days prior to completing the FAFSA.

- All contributors must provide consent and approval to have their federal tax information transferred directly into the student's FAFSA form via direct data exchange with the IRS. If any contributor doesn't provide consent and approval, submission of the FAFSA form will still be allowed. However, a Student Aid Index, which replaces the Expected Family Contribution, will not be calculated and the student won't be eligible for federal student aid.

- Students will be able to list up to 20 colleges on their online FAFSA form and 10 colleges on the FAFSA PDF.

- Users can start or access the FAFSA form by visiting StudentAid.gov and logging in with their FSA ID, where they'll see the link to the FAFSA form on their Dashboard.

Other Notable Changes:

- The definition of family size has changed to align with the number of individuals reported as dependents on the applicant’s (if independent) or applicant’s parents’ (if dependent) U.S. tax return. Applicants may update family size if it changes after filing the tax return.

- The number of family members in college is no longer a factor in the need analysis. Schools may use professional judgment to adjust other data items related to COA or SAI that reflect costs associated with additional family members enrolled in college.

- The net worth of a business is no longer limited to those with more than 100 full-time employees. Applicants will be asked to report the net worth of all businesses, regardless of the size of the business.

- Net worth of a farm now includes the value of a family farm. However, the value of a family’s primary residence is still excluded. The net worth of a farm may include the fair market value of land, buildings, livestock, unharvested crops, and machinery actively used in investment farms or agricultural or commercial activities, minus any debts held against those assets.

Completing the Free Application for Federal Student Aid (FAFSA) is one of the first steps to discovering the best aid options available to making a Christian Education at IWU affordable.

IWU Federal School Code: 001822

- December 1 = priority FAFSA filing deadline to get your financial aid award early

- April 15 = deadline to guarantee maximum financial aid

What is the Federal Student Aid ID (FSA ID)?

The FSA ID is a secure electronic signature. The FSA ID is used to sign the FAFSA, and to also access other secure federal aid websites. Student FAFSA filers, as well as one parent of students who must report parental data on their FAFSA, need their own unique FSA ID.

Carefully follow the instructions when creating or editing your FSA ID. Each FSA ID must be unique; thus, a different email address must be used when each family member creates their own FSA ID.

- TIP 1: Enter your Name (as it appears on your Social Security Card), Date of Birth and Social Security Number!

- TIP 2: No one should ever create an FSA ID for another

Completing the FAFSA

When you are unsure of how to answer a question on the FAFSA, there are two sources of additional guidance to help:

- Within the 'Online FAFSA' - look to the ' Helps and Hints' in the upper right corner (this is available for every question of the FAFSA).

- The Federal Student Aid website also has a lot of great resources.

*Liberty Street Economics 2019